Philippine Coast Guard personnel aboard BRP Sindangan look on as a Chinese Coast Guard ship sails nearby, during resupply mission to troops stationed at Second Thomas Shoal, on March 05, 2024 in the South China Sea. Philippine and Chinese vessels collided in the high seas, leaving four Filipinos with minor injuries after a supply vessel’s windshield was shattered by water cannons, the Philippines said. The incidents happened as the Philippines was conducting a routine resupply mission to troops stationed aboard BRP Sierra Madre, a grounded Navy ship that serves as the country’s outpost in Second Thomas Shoal (locally called Ayungin Shoal). (Photo by Ezra Acayan/Getty Images)

BANGKOK — With China increasingly aggressive around Philippine and Japanese territory, those two US allies are nearing important milestones in their plans to invest in new missiles that will extend the reach of their militaries in the Western Pacific.

By the end of March, the Philippines expects to have its first BrahMos anti-ship cruise missiles, and Japan plans to begin training its personnel to operate Tomahawk missiles. Those acquisitions reflect a growing belief across the region that the best way to counter China in a conflict is with stand-off weapons that could keep Chinese warships at bay.

The two countries are hardly alone in this approach. Beijing’s actions abroad and its missile development at home, as well as similar moves by North Korea, “are undermining regional security and driving other countries to improve their own long-range strike capabilities in response,” the International Institute for Strategic Studies said in a recent report on long-range strike capabilities in Asia.

The missiles sought by Tokyo, Manila and others are not “analogous” to those China and North Korea have, but the focus “on long-range strike capabilities has contributed to a regional arms race that is unlikely to be constrained by arms-control limitations in the foreseeable future,” the report said. “It is therefore highly probable that all the countries of the Asia-Pacific will continue to expand their arsenals horizontally and vertically.”

Manila became the first foreign buyer of the BrahMos missile in January 2022, signing a roughly $370 million contract for three batteries, training, and support. “As the world’s fastest supersonic cruise missiles, the BrahMos missiles will provide deterrence against any attempt to undermine our sovereignty and sovereign rights,” then-Defense Secretary Delfin Lorenzana said when the contract was signed.

The BrahMos, developed by a Russian-Indian joint venture, was chosen for the Philippine navy’s shore-based anti-ship missile system, a part of a years-long effort to modernize the country’s armed forces. The missile has an 180-mile range that would allow it to reach targets around the Spratly Islands or in the strategically vital straits between the Philippines and Taiwan, and a cruising speed of well over Mach 2 that reduces the time targets would have to respond.

Philippine personnel received training on the BrahMos, which will be operated by the Philippine Marine Corps, in early 2023. Delivery was expected by December, but Jonathan Malaya, spokesman for the Philippine National Security Council, has said that the missile systems will arrive by March. (The NSC didn’t respond when asked this week to confirm that date.) Gen. Romeo Brawner Jr., chief of staff of the Philippine military, also said last fall that the army plans to acquire BrahMos missiles, operating them alongside the Marines “to cover gaps” in coastal defenses.

Manila’s BrahMos purchase and military modernization reflect growing concern about external threats, driven by China’s aggressive actions toward Philippine civilians and security forces in the South China Sea. National security documents released in 2018 — a year after the anti-ship missile acquisition was “first conceptualized,” Lorenzana has said — identified South China Sea disputes as the “foremost security challenge to the Philippines’ sovereignty and territorial integrity.”

That situation was underlined by a March 4 incident which saw Chinese Coast Guard ships fire a water cannon at a Philippine vessel, injuring four crew.

The Philippines’ latest military modernization plan, approved in January, is focused on effecting an archipelagic defense strategy by being able to project power “into our areas where we must, by Constitutional fiat and duty, protect and preserve our resources,” Defense Secretary Gilberto Teodoro Jr. said in January.

Manila is “is now trying to operationalize” that strategy, “which talks about securing not only internal waters but of course nearby waters,” Don McLain Gill, a geopolitical analyst and lecturer at De La Salle University, said during an online event in February.

BrahMos missiles and plans to acquire the US-made HIMARS “are seen to be two of the most important aspects and procurements as of this next few months, particularly in order to expedite that strategy,” Gill said.

Recent basing agreements with the US military and tests of other weapons “are further steps toward a distributed deployments for missile strike and defense,” said Tom Karako, director of the Missile Defense Project at the Center for Strategic and International Studies.

Acquiring BrahMos missiles “is interesting” as it raises questions about dependence on Russian technology, Karako added, “but it nevertheless reflects an increasing demand signal for advanced strike capability.”

Japan’s ‘Counterstrike’ Plan

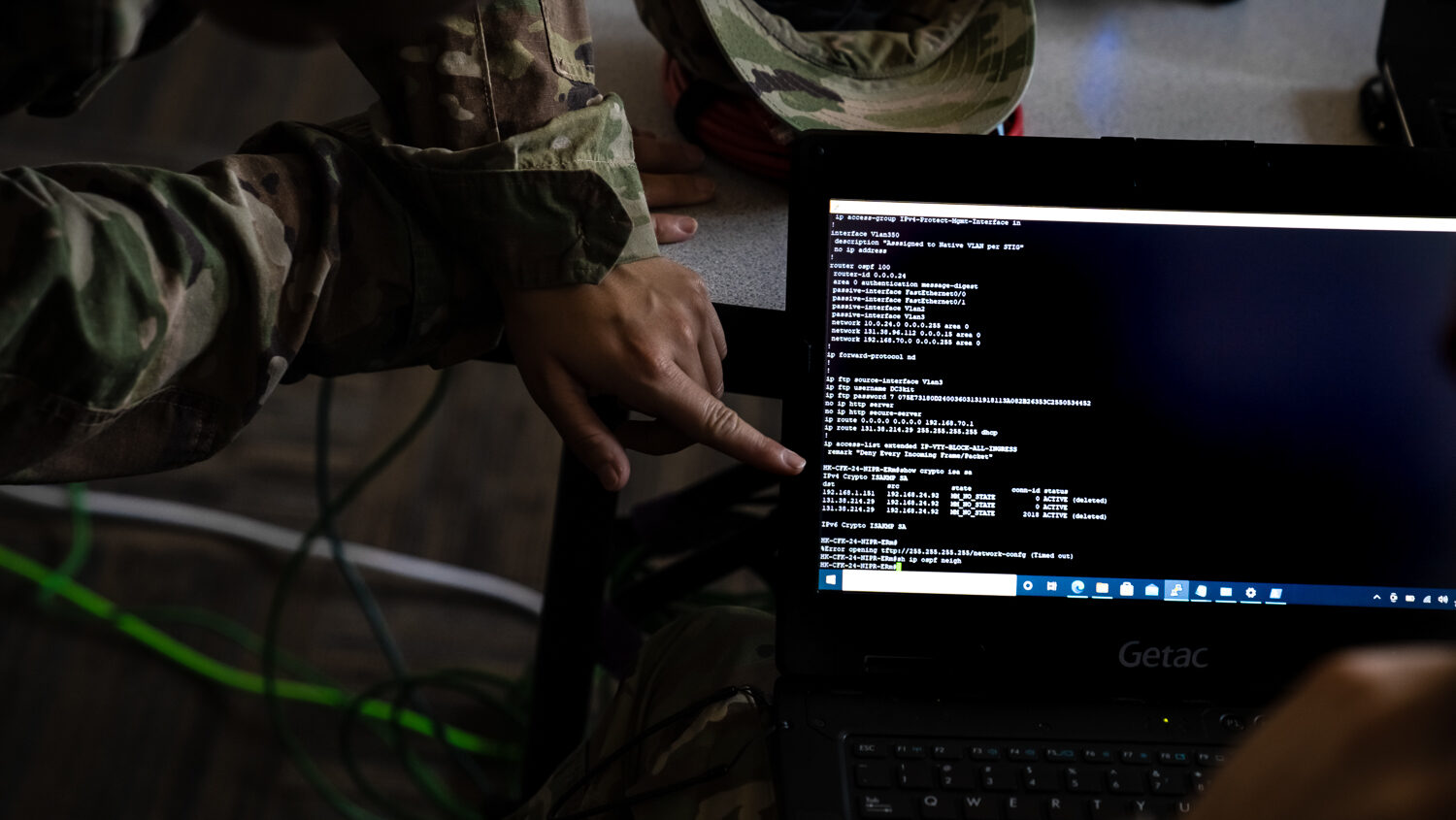

Japan’s decision in late 2022 to develop a counterstrike capability allowing it to launch attacks on enemy forces was a major shift of its post-war commitment to limit its military to self-defense capabilities. It came in response to Chinese and North Korean missile threats that made missile defense alone untenable, according to the National Security Strategy released in December 2022.

“Missile attacks against Japan have become a palpable threat,” the strategy said. “Counterstrikes are done as a minimum necessary measure for self-defense,” and by having that capability, “Japan will deter armed attack itself.”

Japan’s Defence Minister Minoru Kihara (R) and US Ambassador to Japan Rahm Emanuel exchange a contract regarding Japan’s introduction of the US-made long-rage Tomahawk missile at the Defence Ministry in Tokyo on January 18, 2024. (STR/JIJI Press/AFP via Getty Images)

In the event of an invasion attempt, a stand-off strike capability would also be needed “to block and eliminate the invading forces from outside the opponent’s threat envelope as early and as far away as possible,” the 2023 edition of Japan’s annual defense white paper said.

That capability will be provided by long-range missiles, both domestically developed and bought overseas. The first of those foreign missiles is the US-made Tomahawk, which has a 1,000-mile range that would bring targets in North Korea and eastern China into reach.

Japan initially planned to buy 400 of the newest Tomahawk variant, the Block V, for delivery in 2026 and 2027 and deployment aboard the Japanese destroyers equipped with Aegis ballistic-missile-defense systems. (References to defeating both enemy missile launchers and invasion forces suggest Japan wants a mix of land-attack and anti-ship Tomahawks, the IISS report said.)

But Defense Minister Minoru Kihara said in October that rising tensions made the Tomahawks a higher priority, and Tokyo instead requested 200 Block Vs and 200 Block IVs, an older variant that could be delivered starting in 2025. The US approved the purchase in November and Kihara signed a contract with US Ambassador to Japan Rahm Emanuel in January. Officials said in February that Japanese naval personnel would begin training to operate the missiles in late March. (Japan’s Defense Ministry did not respond when asked this week to confirm that date.)

Emanuel praised the moves, saying in January that Japan had “front-loaded the funding rather than space it out over the series of years to demonstrate their commitment to its procurement and to their deterrence.”

Alongside Tomahawks and accelerated deployment of its upgraded Type-12 anti-ship missile, which will have a range extended fivefold to more than 600 miles, Japan is buying F-35s, converting its helicopter carriers into light aircraft carriers, and investing in defenses on its southwest islands, said Benjamin Blandin, network coordinator at the Yokosuka Council on Asia-Pacific Studies.

“All of this, in addition to all of the equipment given to Southeast Asian nations, speaks volumes about Tokyo’s seriousness and all-domain preparations,” Blandin added.

C2 Help Still Needed

Japan and the Philippines are not alone in their investments. Australia is also seeking US-made long-range missiles and working with the US military to develop ground-based long-range fires.

“Both Australia and Japan in their recent defense security reviews put long-range strike and air and missile defense as their top two modernization priorities,” Karako told Breaking Defense.

Tokyo and Canberra acquiring long-range strike capability “represents an historic and much-needed step to boosting conventional deterrence in the region,” Karako said, adding that cooperation on missile and hypersonic strike capabilities is “at the center of how the United States and its allies are contending with the emergence of a new missile age.”

Visitors look at a display of India’s Defence Research and Development Organization (DRDO) Brahmos missile at the DefExpo 2018, a large defence exhibition showcasing military equipment, on the outskirts of Chennai on April 11, 2018. (ARUN SANKAR/AFP via Getty Images)

While new missiles will extend their reach, those militaries may still need help to put them on target.

Australia is investing more in its intelligence, surveillance, and reconnaissance capabilities, but its “long-range strike capabilities are likely to remain reliant on US support for the broader architecture of C4ISR enablers,” the IISS report said.

The Philippines’ maritime-strike capability faces similar issues, “including a lack of dedicated military satellites and only a limited number of surface vessels and aircraft equipped with long-range sensors,” according to the report. US support has helped address those gaps but “Manila will need additional equipment to link its kinetic capabilities to its command and control more effectively.”

For Japan, adding a land-attack mission to warships already tasked with ballistic-missile defense “would place a significant burden on these vessels in a conflict,” the report said, noting that Japan’s assets for detecting and tracking targets are also “inadequate.”

Tokyo is investing in satellites and radars to improve its awareness and plans to set up a joint command to facilitate coordination among its forces and with the US, but its lack of experience means its “future counterstrike capabilities are likely to remain under the umbrella of the US–Japan alliance,” the report said.

Christopher Woody is a defense journalist based in Bangkok. You can follow him on Twitter and read more of his work here.