A U.S. Air Force F-16 Fighting Falcon assigned to the 77th Expeditionary Fighter Squadron flies within the U.S. Central Command Area of responsibility, March 20, 2023. (U.S. Air Force photo by Tech. Sgt. Daniel Asselta)

WASHINGTON — Burgeoning international weapons demand is poised to spur “multibillion-dollar” sales for Northrop Grumman on programs like F-16 electronic warfare modernization and air and missile defense battle management, company executives projected today.

Speaking to investors during the defense giant’s first quarter earnings call for 2024, which beat analyst expectations, Chief Executive Officer Kathy Warden said that exports currently make up about 14 percent of the contractor’s overall sales. While executives don’t expect that number to change “significantly” in the near term, Warden said Northrop anticipates that international sales will grow at a faster rate than domestic deals as sales are executed in the coming years.

The robust international demand “is the strongest that I’ve seen in a long time,” she said.

Specifically, Warden pointed to a few key programs that are informing the company’s rosy outlook on international expansion. One is the Integrated Viper Electronic Warfare Suite (IVEWS), a new EW system for the F-16. Northrop has booked two international customers already and is in talks with seven others, Warden said, which “has the potential to be a new multibillion-dollar product line for us.”

Additionally, fresh off a successful sale to Poland, Warden said that she sees global demand for the company’s Integrated Air and Missile Defense Battle Command System (IBCS) materializing in a “pipeline” worth roughly $10 billion.

RELATED: Inside Northrop’s plan to dramatically increase defense exports over the next decade

Other sales opportunities are growing as export restrictions on certain platforms are relaxed, according to Warden. One example she cited is the MQ-4C Triton maritime surveillance drone: NATO is looking to expand its maritime surveillance capabilities, Warden said, which could offer the chance to sell up to five Tritons to the alliance. Other customers in Europe are interested in the platform as well, though she did not say who.

To score wins on those product lines, Northrop will likely have to aggressively compete. L3Harris, for example, is pitching its Viper Shield F-16 EW suite and has already booked multiple foreign customers. Similarly, Northrop has stiff competition for battle management capabilities from the likes of Lockheed Martin. And, NATO would presumably have other options for maritime surveillance.

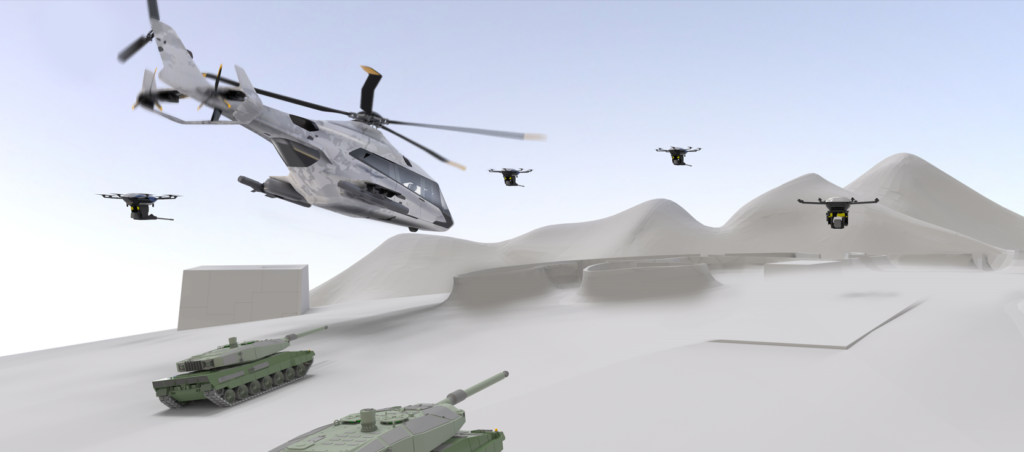

Generally, Warden said Northrop would look to offer autonomous systems as global drone demand grows, though the company suffered a setback yesterday after the US Air Force decided to proceed with only General Atomics and Anduril for the service’s Collaborative Combat Aircraft program.

Warden today downplayed that loss, saying that the phase the service down-selected for yesterday “was relatively small” and that more opportunities lay ahead. Looking forward, she said the company doesn’t want to be seen as only offering “exquisite and expensive technology,” though she cautioned that desire would only go so far.

“We are really positioned to provide the best solutions that our customer needs against a high end threat. However, we are not looking to compete in a more commoditized part of the market that’s very low cost and not survivable systems. That’s just not our business model and we know that,” she said.

![The sights from the 2024 Farnborough Airshow [PHOTOS]](https://centurionpartnersgroup.com/wp-content/uploads/2024/07/IMG_8722-scaled-e1721930652747-1024x577-hZjwVb-500x383.jpeg)