Soldiers stand near an Israeli Air Force Iron dome defense system on November 23, 2023 in Central Israel. (Photo by Alexi J. Rosenfeld/Getty Images)

JERUSALEM — Israel Aerospace Industries CEO Boaz Levy said he remembers the first days after the Hamas attack on Israel on Oct. 7, 2023. It meant a clear break with the past.

“We found ourselves on Oct. 7 in a different situation and different environment and knew right away that this wasn’t like a usual operation and that something else was going on,” he said in an interview with Breaking Defense.

IAI called in personnel on the first day of the war, he said. “We began by analyzing the situation and what we anticipated the needs would be as Israel defended itself.”

Israel’s three largest defense companies, IAI, Elbit Systems and Rafael Advance Defense Systems, have seen record sales over the last two years, and they have seen increasing demand for their systems, especially since Russia’s February 2022 invasion of Ukraine.

But five months into the conflict in Gaza, executives at the firms said their companies have felt the strain of the war. The shock of the Oct. 7 attack, the call-up of employees to reserve duty, and the move to 24/7 production all made the last five months the most intense in Israel’s history for the three companies, executives at each told Breaking Defense.

RELATED: As Israel aims for more ‘focused’ operations in Gaza, key questions remain for endgame

In addition to IAI’s Levy, Breaking Defense spoke to Ran Kril, executive vice president of international marketing and business development at Elbit, and with Gidi Weiss, vice president of strategy, business development and marketing at Rafael.

“There was a lot of uncertainty during the first few days, and we worked together with Israel’s Ministry of Defense to assess their needs and the solutions we could provide to help them defend the State of Israel,” Levy said. “IAI is a government-owned company and as such we see ourselves as part of Israel’s defense system.”

Employees Called Up, Tech Put To The Test

At Elbit, Kril said that in the first days of the war a “substantial” number of the private firm’s 20,000 employees were called up to reserve duty. Israeli men and women serve in the IDF and then can be called up for the reserves in the decades after their mandatory service ends.

“We had at the beginning a couple of weeks of ambiguity in order to provide the maximum support for our customers,” Kril recalls. He said that 80 percent of the company’s revenue comes from customers outside of Israel. As such, the company doesn’t have the luxury to not support those customers. But Kril said that even with the call-ups, there was not a “severe impact” on the company’s ability to support customers abroad.

Elbit makes numerous systems for the IDF, from the Hermes drone to munitions for the artillery, as well as the new Iron Sting mortar, and Iron Fist active protection for the Eitan APC.

“We have reorganized our operations in supply chains and production, and we have substantially recovered and we are quite ok with our customers,” he said. “I wouldn’t say it is perfect. It is stable.”

RELATED: Why sending a US Navy hospital ship to Gaza would be very difficult but ‘not impossible’

After five months, with many of the employees back from the reserves as Israel redeploys forces and shifts gears in Gaza, the company is improving its deliveries to its customers, Kril said. Still, he said the company will hire around 1,000 employees this year.

“Many of them have been recruited to support production that is working 24/7, as the war is moving forward,” he said.

At Rafael, which is government-owned and a historic wheelhouse of research and development for Israel’s Ministry of Defense, around 2,000 of the 9,000 employees went to the reserves, according to Weiss. He said another 250 families of employees had been displaced by the war after Israel evacuated almost 200,000 people from border communities near Gaza and Lebanon.

RELATED: ‘Not an exaggeration’: Fears rise of Israeli incursion into Lebanon to push back Hezbollah

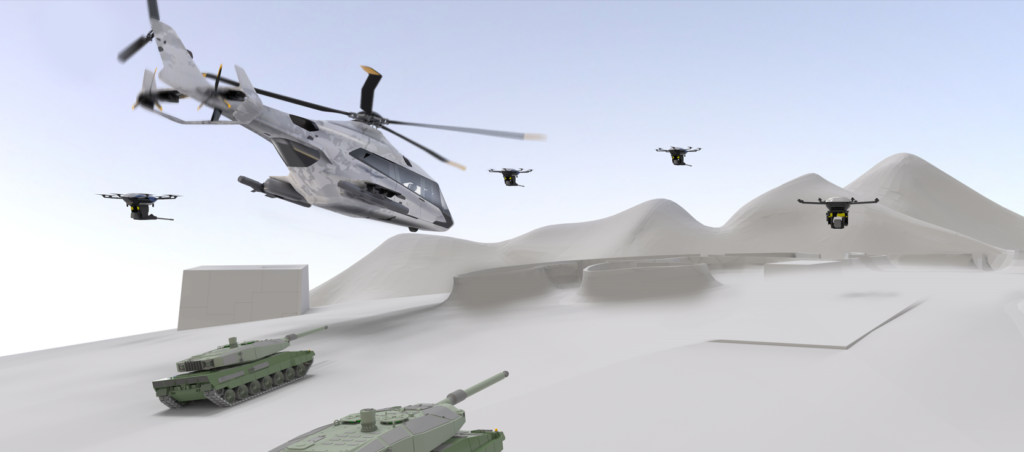

Rafael makes many key systems central to Israeli operations, such as the famous Iron Dome air defense system, as well as the Trophy active protection system — a tech platform that can be mounted on armored vehicles or tanks and guard against incoming aerial threats.

Weiss said these systems faced off against a “never in history” type of event in Gaza, due to the crowded urban battlefield and volume to RPG and anti-tank missile fire directed at Israeli forces.

“There were a few casualties and lessons learned, but to think the amount of the threats shot and the few casualties we have had is mind boggling,” he said.

Israel says 249 of its soldiers have perished since Jerusalem began its counter-attack after Oct. 7, which has also claimed the lives of an estimated 30,000 Palestinians.

OPINION: The case for an immediate, US-led stabilization mission in Gaza

Rafael also makes the Firefly loitering munition, which has been used for the first time extensively in the Gaza conflict, Weiss said. The company’s Typhoon weapon station naval mount has also seen use in the war as Israeli naval forces support ground operations in Gaza.

Meanwhile IAI, like the other companies, moved to three shifts a day, working seven days a week to meet the needs of the IDF, Levy said. The company has 15,000 employees, and Levy estimates around 2,000 were called up.

Future Prospects

In the wake of Russia’s invasion of Ukraine, several nations, especially in Europe, began looking eagerly for new defense tech and equipment to better deter further aggression and prepare themselves should it come anyway. That has meant some big business for Israeli firms, whose systems have been tested more than most in real-world combat.

Germany, for instance, purchased the Arrow air defense system, jointly developed with the US and made by IAI, in 2023. The David’s Sling air defense system, also developed with the US and produced by Rafael, was sold to Finland.

As they’re sold abroad, both systems have now scored numerous interceptions in the recent war as Hamas and other Iran-backed groups like the Houthis in Yemen and Hezbollah in Lebanon lob rockets, missiles and drones at Israeli targets.

But considering the large number of deals the companies have announced in the last two years, in the first five months of the war the companies appeared to be laying somewhat low, both in terms of big announcements and presence at international defense shows.

Each exec said, however, that’s not the case.

“We are continuing to sign deals and attend trade shows, most recently at the Singapore Airshow and we will be at upcoming shows in Chile and Paris,” says Levy. “Our financial report will be published next month which will include the first quarter of 2024 along with the summary of 2023, of which the war took place during the last quarter. When the report comes out, you will see that our new orders are doing quite well when compared to last year’s orders, you have to wait until we publish.”

Elbit’s Kril said his company, too, is not “trying to hide.”

“Usually at the beginning of the year we don’t participate in numerous shows and exhibitions. We are planning this year for Germany and Eurosatory and UK Farnborough and RIAT [Royal International Air Tattoo] so everything is as planned, and we have others [we will attend].”

He said the war hasn’t resulted in a delay or reduced appetite for the company’s solutions, “maybe on the contrary.”

At Rafael, the company has focused on operationally relevant announcements, according to a company spokesperson. Weiss noted that the first foreign exhibition the company attended was in early January in the United Kingdom, the International Armoured Vehicles conference.

“People showed up because they knew the active protection and reactive armor worked hand-in-hand protecting vehicles and soldiers, enabling smooth operation and mission,” Weiss said.

The company has maintained business as usual, he said, amid protests against the war abroad.

Altogether, the executives from the three Israeli companies are confident that their systems have performed as expected in this intense period. Now, five months in, the companies are preparing to return to international exhibitions, looking for their next customers abroad.

![The sights from the 2024 Farnborough Airshow [PHOTOS]](https://centurionpartnersgroup.com/wp-content/uploads/2024/07/IMG_8722-scaled-e1721930652747-1024x577-hZjwVb-500x383.jpeg)