U.S. Marine Corps Sgt. Timothy Allen uses a tablet-based interface to maneuver a Small Unmanned Ground Vehicle during Constant Vigilance on Camp Courtney, Okinawa, Japan, Oct. 19, 2021. (U.S. Marine Corps photo by Lance Cpl. Alex Fairchild)

Longtime defense contractors expect their business will be caught up in conflict — that’s the name of the game, after all. But the Ukraine war has thrust commercial tech giants to the forefront and into the spotlight. In the op-ed below Georgetown University’s Center for Security and Emerging Technology (CSET) researchers Sam Bresnick and Emelia Probasco ask a simple question with a complicated answer: How does Big Tech’s calculus change if the fight’s not in Ukraine, but in Taiwan?

Searching for war criminals, identifying battlefield casualties, and tracking the movements of militaries are not the typical subjects of boardroom conversations at US tech companies. That is until two years ago when Russia launched its full-scale invasion of Ukraine.

After that moment, these companies and their CEOs made choices that influenced the course of the war. They provided cutting-edge capabilities that fortified Kyiv against Moscow’s initial assault; Palantir software supported Ukraine’s targeting of invading Russian forces, SpaceX’s Starlink enabled battlefield communications, and numerous satellite companies helped Ukrainian forces track the activities of Russian troops. Throughout the conflict’s early stages, these and other firms, including prominent Big Tech players, made decisions that aligned with US goals.

Unlike their government counterparts, however, companies were not animated by nation-state concerns like diplomatic commitments or electoral politics. Many did so because they believed it was the right thing to do, they possessed useful capabilities, and because their businesses did not depend on Russia. Microsoft, Apple, and Google, for example, made around 1 percent of their total revenue in the country and did not rely on local manufacturers, and start-ups that supported Ukraine had no operations in Russia.

It is unclear, however, if these conditions will hold in the case of a conflict over Taiwan.

As one of us argues in a recent report, several of the companies that came to Ukraine’s defense have much deeper economic ties to China than they did to Russia, and those connections could expose them to Chinese coercion. For example, Tesla reportedly manufactures over 50 percent of its electric vehicles in China, while Apple produces 95 percent of its hardware in the country. Both companies earn around 20 percent of their revenue there. Microsoft and Amazon conduct AI- and computer science-related research in China. These companies, along with Cloudflare, Google, Cisco, and Oracle, all of which supported Ukraine to some degree, have other business interests in China that could affect their decisions about supporting Taiwan in a conflict.

So what, if anything, should the US government do about these entanglements? There are no easy solutions. Preemptively forcing companies to eliminate their connections to China, often referred to as “decoupling,” would be costly and may not lead to geopolitical stability.

China-corporate connections may inhibit escalation. Fully dismantling these linkages before a conflict would lower the costs of going to war. Moreover, doing business in China still benefits the US economy, bringing in substantial foreign revenue streams and allowing US companies to access China’s brightest minds.

Additionally, many Big Tech companies are already somewhat “de-risking” their connections with China. For example, Apple has announced plans to shift a significant portion of its iPhone manufacturing to India and elsewhere. Tesla has agreed to construct a factory in Mexico and is exploring building others in Italy and India. Google no longer conducts AI research in China, and Microsoft, which does, announced it would relocate scientists from China to Canada while reportedly debating the future of its China-based research arm.

But Washington should consider incentivizing companies to support US efforts in the event of a Taiwan contingency.

For example, the US government could support companies’ business-motivated “de-risking” plans and make it easier to base foreign researchers in the United States. Initiatives like the Global AI Talent Attraction Program, established through the recent AI Executive Order can help. Similarly, programs like the IPEF Supply Chain Agreement can support the supply chain diversification plans companies are already pursuing. And high-level engagements like the US-India CEO Forum can surface opportunities for companies to foster better business relationships with partner countries.

It will also be critical for the U.S government to foster a more robust and diversified defense supplier base, one that includes companies that are less vulnerable to Chinese coercion. Some of Elon Musk’s companies, for example, have become important government contractors, but given his deep ties to China, it would be useful to have other options. Investments in alternative private space launch and satellite communications providers, as well as the Pentagon’s own military launch capabilities, would reduce the need for wartime charity from businesses such as Musk’s SpaceX.

Another way to reduce uncertainty for military planners is to make better use of government contracts. At the outset of the war in Ukraine, several companies, including SpaceX, provided services to Ukraine pro-bono. Rather than rely on corporate initiative, the government should be able to rapidly contract for the services it needs in a crisis. (The Pentagon since contracted with SpaceX for services in Ukraine.)

Even with lightning-fast contracting, redundant commercial and government capabilities, and appropriately “de-risked” corporate linkages with China, companies will likely be forced to make difficult decisions amid future conflicts. Executives and boards in the United States should carefully consider how they plan to navigate wartime choices that will not be as straightforward as they were in Ukraine.

Will they work with the US Department of Defense or Taiwan’s Ministry of National Defense, and under what conditions? Will they defend their platforms from any attacker or pick sides in a conflict? Will they seek out the benefits of global connections or the safety of operating within sharply defined borders?

Confronting these questions now would go a long way toward preparing both Washington and Taipei for potential future conflicts.

Sam Bresnick is a research fellow at Georgetown University’s Center for Security and Emerging Technology (CSET). Emelia Probasco is a senior fellow at Georgetown University’s Center for Security and Emerging Technology (CSET).

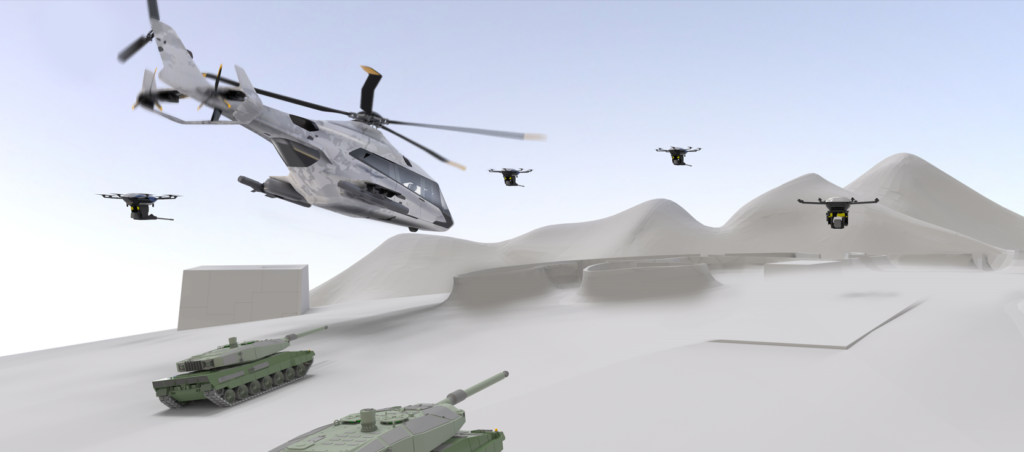

![The sights from the 2024 Farnborough Airshow [PHOTOS]](https://centurionpartnersgroup.com/wp-content/uploads/2024/07/IMG_8722-scaled-e1721930652747-1024x577-hZjwVb-500x383.jpeg)