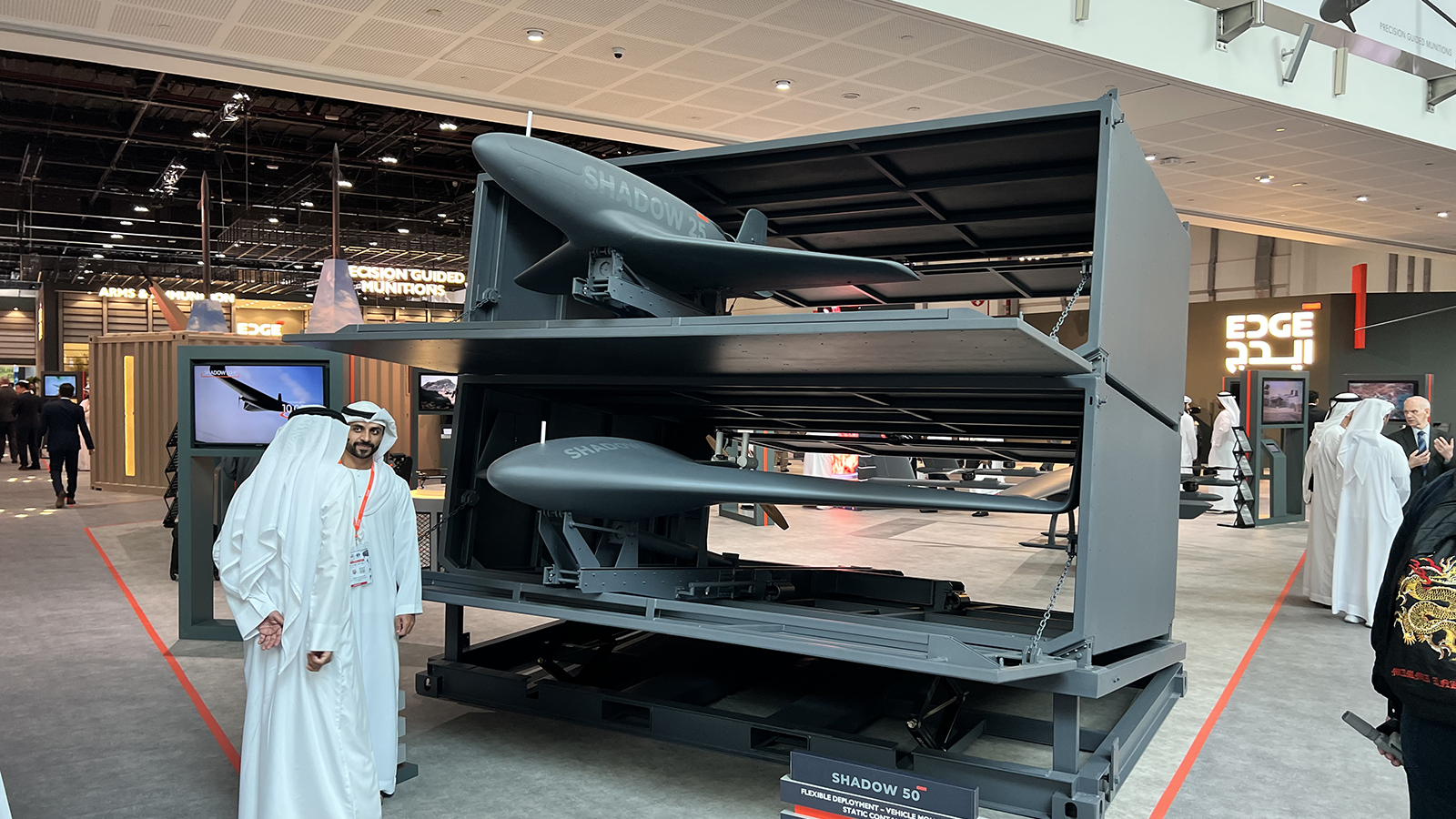

EDGE Group shows off some unmanned aerial vehicles at the IDEX defense expo in Abu Dhabi in 2023. (Breaking Defense)

BEIRUT — Five years after its establishment, UAE defense conglomerate EDGE Group is celebrating its growth with what it says is an order backlog worth $12.8 billion.

“Since its inception in 2019, EDGE has expanded its product portfolio from 30 to 201 cutting-edge solutions across air, land, sea, and cyber domains — a rapid growth of more than 550% in just five years,” the company said in an announcement Monday.

EDGE said that its annual revenue amounted to $4.9 billion in 2024, and it now has products in 91 countries.

“In a constantly evolving and highly competitive international defence landscape, it was almost inconceivable that a new disruptor from the UAE could, in just five years, rise so rapidly to become a global industry player punching way above its weight across multiple domains,” EDGE Chairman Faisal Al Bannai said in the statement.

EDGE is a state-owned defense conglomerate with more than 25 entities dedicated to developing and producing defense solutions in all domains. The conglomerate has consolidated a number of national defense firms and struck joint ventures (JV) with international firms to boost local production and decrease reliance on — and to better compete with — Western products.

“EDGE’s footprint is reinforced by a total of 13 international acquisitions and strategic investments, including stakes in key companies such as Estonia’s MILREM Robotics, Swiss unmanned helicopter manufacturer ANAVIA, Brazil’s non-lethal tech leader Condor, and Brazil’s smart weapons specialist SIATT,” the statement says. “These acquisitions, along with nine others, have enhanced EDGE’s capabilities across land, sea, air, and cyber domains, unlocking opportunities in cutting-edge sectors and strengthening its competitive edge globally.”

Additionally, EDGE has entered in 23 joint ventures to expand its production and development. The lates, dubbed MAESTRAL was inked with Italian shipbuilder Fincantieri in February to produce vessels in Abu Dhabi.

EDGE has also expanded its presence in emerging markets in Latin America where it launched its first international office in Brazil in 2023 and bought half of the shares of Brazilian SIATT smart weapons firm that same year.

Following the normalization of the relationship between the UAE and Israel, EDGE had signed an agreement with Israeli Aerospace Industries (IAI) to codevelop counter unmanned aerial systems. It then invested in Israeli firm High Lander, the provider of an unmanned air traffic management in 2023.

“The setting up of joint ventures with top international original equipment manufacturers (OEMs) and the acquisitions of majority shareholdings in small- and middle-sized companies in the defense and tech sectors are at the cornerstone of EDGE’s model of business growth and expansion,” Gulf State Analytics analyst Leonardo Jacopo Maria Mazzucco told Breaking Defense.

He added that through the years “EDGE has captured larger shares of the UAE’s procurement contracts awarded at [Abu Dhabi defense conference] IDEX and generated more significant revenues from export sales.”

But Mazzucco said the sprawling firm still has work to do. “While EDGE has proved capable of bringing to bear its entrepreneurial ambitions, it needs to ensure the long-term sustainability of its investments in R&D, industrial partnerships, and localization efforts in order to fully affirm itself as a truly competitive global industrial player,” he concluded.