Bell’s V-280 Valor won the US Army’s Future Long-Range Assault Aircraft competition (Bell)

BELFAST — Bell and Leonardo hope to jointly begin concept study work on a future tiltrotor aircraft in the next four months as part of NATO’s Next Generation Rotorcraft Capability (NGRC) program.

The American and Italian manufacturers agreed to collaborate on tiltrotor technology “opportunities” last month as part of a Memorandum of Understanding (MoU), and are currently in the process of responding to a NGRC Request for Proposal (RFP).

“Should Bell and Leonardo be awarded one of the up to three contracts” on offer, “work on a concept study could begin as early as July,” a Bell spokesperson told Breaking Defense in a statement.

“Leonardo’s work on the AW609 [civil tiltrotor] and its Next Generation Civilian Tilt Rotor (NGCTR) initiative and Bell’s long-standing work with tiltrotor technology will factor into the work for NGRC,” added the spokesperson. “Leonardo will take the lead on a tiltrotor architecture proposal with Bell in support.”

Bell previously partnered with AgustaWestland, since rebranded as Leonardo, on the BA609 tiltrotor program, before leaving the joint venture in 2011. The Italian firm has gone on to develop the AW609 independently.

Bell’s V-280 Valor tiltrotor was selected by the US Army for the Future Long-Range Assault Aircraft (FLRAA) program in December 2022, and US services operate the older Bell-Boeing V-22 Osprey.

RELATED: 3 questions following the Army’s FLRAA decision

The RFP under assessment by Bell and Leonardo sits under NATO’s NGRC Concept Study 5/Integrated Platform Concepts line of effort, connected to a largely five-part plan in which industry is partly involved. Each of the three contracts available for Concept Study 5 are valued at €5.7 million ($6.2 million) and are set to last up to 15 months, according to NGRC tender documents. Bidders have until the deadline of April 26 to respond to the RFP.

NATO has stressed that Concept Study 5 relates to how different concepts can support NGRC “attributes” and will not explore existing aircraft “designs or solutions.”

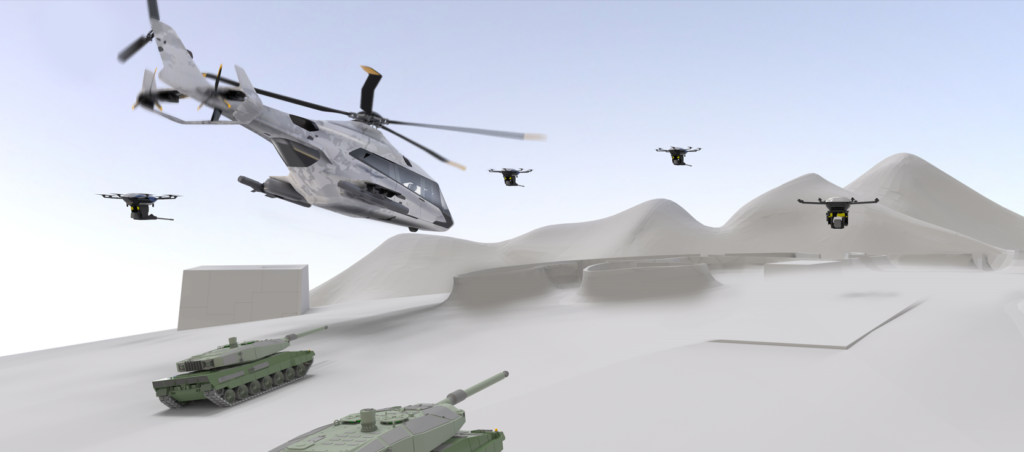

At a wider level, NGRC requirements mainly cover a future medium lift helicopter that costs no more than €35 million ($38.2 million) per aircraft and provisionally planned to enter service between 2035 and 2040. In that timeframe, around 900 medium-lift rotorcraft are expected to retire across the alliance.

The new helicopters are also expected to have a cost-per-flight hour no greater than €10,000 ($10,920), an availability rate above 75 percent, an unrefueled range of 1,650 kilometers, an optimal cruise speed of 220 knots (253 miles per hour), an ability to carry between 12 and 16 combat equipped troops and have a load lifting capacity greater than 4,000 kilograms, according to NATO Support and Procurement Agency documents [PDF].

The cruise speed target is one of the most significant elements of NGRC as it represents a technological leap away from conventional or in production helicopters which can typically fly at a maximum speed of 130 knots.

NATO members France, Germany, Greece, Italy and the United Kingdom launched the multinational NGRC effort in 2020, with the Netherlands joining in 2022. Canada is also expected to join the program soon. The US and Spain both retain observer status.

“Allies, in cooperation with Industry, will explore how to match their needs with the latest technology on the market, looking at options such as hybrid and electric propulsion, a systematic open system architecture, and the delivery of radically improved flight characteristics,” notes NATO literature.

NATO awarded US giant Lockheed Martin an NGRC non-proprietary open system architecture concept study contract (Concept Study 3) valued at up to €2 million ($2.2 million) in January, a month after General Electric was similarly awarded a novel powerplant solution (Concept Study 1) contract.

Concept Study 2, covering a concept of operations, or CONOPS, will focus on operational analysis activity at a multinational level, throughout this year. That study is not open to industry. Delivery of a CONOPS development program running in parallel, is set to end with the release of CONOPS version 2.0 in the fourth quarter of 2025.

Manufacturers are also excluded from Concept Study 4, classed simply as “Technologies,” but work in the area is expected to feed into Concept Study 5 on integrated platforms.

Jay Macklin, business development director at Sikorsky, a Lockheed Martin subsidiary, said in a briefing with Breaking Defense and other media last month that the company will wait to see “what the final set of requirements look like” for NGRC, before deciding to formally offer an aircraft based on X2 compound helicopter technologies. That pitch would stand as direct competition to any tiltrotor design from Bell and Leonardo, depending on how program plans advance beyond concept developments.

X2 designs were the backbone of Sikorsky’s S-97 Raider/Raider X and larger SB>1 Defiant. The US Army’s recently cancelled Future Attack Reconnaissance Aircraft program ended the service’s interest in Raider X, while the SB>1 Defiant lost out to the V-280 for FLRAA.

Airbus Helicopters has also expressed an interest in NGRC and could eventually move out with an offer based on the civil high speed RACER design.

![The sights from the 2024 Farnborough Airshow [PHOTOS]](https://centurionpartnersgroup.com/wp-content/uploads/2024/07/IMG_8722-scaled-e1721930652747-1024x577-hZjwVb-500x383.jpeg)