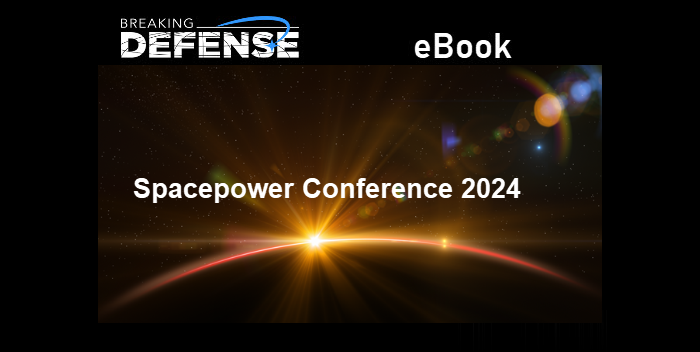

Members of the Argentine delegation including Defense Minister Luis Alfonso Petri (3rd R) hold their national flag as they pose in front of a F-16 fighter during a press event of the sidelines of an agreement signing on the purchase of Danish F-16 aircraft at Skrydstrup Air Base, Denmark, on April 16, 2024.(Photo by Bo Amstrup / Ritzau Scanpix / AFP) / Denmark OUT (Photo by BO AMSTRUP/Ritzau Scanpix/AFP via Getty Images)

WASHINGTON — The surprise decision by Argentina to seek a rare partner status with NATO, coupled with Buenos Aires’s recent choice of Dutch F-16s for its next fighter fleet over Chinese rivals, appears to have handed the West some clear victories in a tug of war with Beijing over influence in the South American nation. But analysts told Breaking Defense the game is long, and China has many cards — especially economic and commercial ones — still in hand.

“China is still China, and Argentina is still very much not out of the woods regarding its economic panorama. Hence China is still a key partner, while [Argentine President Javier] Milei is very pragmatic,” Ryan Berg, director of the Americas Program at the Center for Strategic and International Studies, told Breaking Defense. Berg called the Buenos Aires-Beijing relationship “slightly more tense than previously.”

Ariel González Levaggi, director of the Center of International Studies at Argentina’s Pontifical Catholic University, went further, saying the Argentina-China relationship is the “worst” it has been “with the arrival of Javier Milei to the presidency.” But he too noted the “strong economic and financial links” binding Argentina to China.

China ranks as Argentina’s second trading partner, only after Brazil. Commercial Chinese companies have a strong presence in country, particularly companies mining lithium in the northern provinces, and “China has a direct line of credit to their Central Bank,” Berg said, adding that the total amount of the swap line is “somewhere around 18 billion dollars.”

“Argentina is still very dependent on the commercial and financial links with China,” explained Andrei Serbin Pont, president of Argentina’s CRIES think tank.

But there are flashpoints to watch as Argentina navigates its future between the polar attractions of Washington and Beijing. Key among them: defense deals and a controversial space facility.

F-16s, APCs and NATO

Last week Milei announced his nation would purchase 24 Danish-owned, American-made F-16s for $300 million, marking the end of a years-long competition that had pitted Denmark’s birds against airframes made by India and a Chinese-Pakistani team.

It also marked the most recent rejection of Chinese military tech by Argentina. China’s NORINCO had also offered its 6×6 WMZ-551B1 armored vehicles to the Argentine Army, but in 2023, Buenos Aires announced that Brazil’s Iveco 6×6 Guarani armored personnel carriers (APC) were selected for that competition.

That project has not moved forward, but Serbin Pont said that Buenos Aires is now looking at an American, not Chinese, option — specifically the potential acquisition of brand new or second-hand Stryker armored fighting vehicles. (Argentina did acquire four NORINCO WMZ-551B1 armored vehicles in 2010, to be used in peacekeeping missions. As recently as last year then-Defense Minister Jorge Taina met with senior NORINCO officials to discuss, in part, modernizing those vehicles currently stationed at a base in Toay, La Pampa province.)

Making matters worse for China, retired Brazilian Army Col. Paulo Roberto da Silva Gomes Filho told Breaking Defense that Beijing’s “discomfort” is increasing as ties between senior US and Argentine officials appear to strengthen.

“US SOUTHCOM commander Gen. Laura Richardson recently visited Argentina, where she spoke with President Milei about US participation in constructing a military base in Ushuaia [on the country’s southern tip] and also attended the donation of a C-130 Hercules aircraft,” he said.

During Richardson’s visit, which took place days before the F-16 announcement, she said, “The ties between our armed forces are as strong and deep-rooted as the ties between our citizens.

“We are committed to working closely with Argentina so that our collaborative security efforts benefit our citizens, our countries and our hemisphere in lasting and positive ways,” she said.

Then, when Argentine Defense Minister Luis Petri visited Copenhagen, he announced Argentina planned to apply for to NATO’s Global Partners program. If selected, the country would be the program’s second-ever Latin American member; Colombia joined in 2017.

A senior NATO official said he “welcomed” the news, adding that “closer political and practical cooperation could benefit us both.”

Lastly, the US government announced last week approval for a potential $143 million defense deal in which Argentina would buy Basler BT-67 Aircraft prop planes, as well as new Foreign Military Financing to the tune of $40 million — the first time Argentina received FMF from the US since 2003.

“FMF is a security assistance grant reserved for important partners,” the US Embassy in Argentina said at the time. “FMF enables Argentina to purchase U.S. defense articles, training, and services via grant assistance and enhances interoperability with U.S. forces. This funding will advance Argentina’s military modernization effort, supporting Argentina’s purchase of F-16 supersonic fighter jets.”

Space Facility In Question

If one installation could serve as a bellwether for Chinese-Argentine relations, a space facility in the Neuquén province may fit the bill. The facility is the product of a decade-old agreement between Beijing and Argentina and is reportedly operated by the Chinese military.

Washington is well aware of, and concerned by, the facility. In its 2024 Posture Statement, US Southern Command wrote, “the PLA [People’s Liberation Army] continues to invest and improve its military space capabilities, including a deep space station in Argentina, providing the PLA with global space tracking and surveillance capabilities.”

The future of Beijing’s station could be in jeopardy, however, as “there are criticisms [in Argentina and Washington] about the space station in Neuquén, where Argentina is taking a strong stance,” explained CRIES’s Serbin Pont.

CSIS’s Berg said that Milei’s suggestion he may order inspections of the facility was likely to add strain to the diplomatic strain.

Playing The Long Game

Looking to the future, when it comes to defense deals the analysts were doubtful Beijing would energetically pursue Argentinian defense competitions soon after their recent losses.

Serbin Pont said believes that China’s defense industry will have very limited options to procure new contracts. “In the future, I think Argentina will prioritize acquisition programs for the Navy, specifically the surface and submarine fleets,” he said. Thus, “it is very unlikely that there will be Chinese offers which could be competitive, particularly against European proposals.”

Da Silva Gomes Filho said he thinks Beijing might jump into a competition to supply the military, but it will also likely “re-structure its priorities and select another South American country” to offer its defense systems. González Levaggi also believes Beijing will, in the short term, “look for other potential customers [in the region] besides Argentina.”

While the Argentine military will not fly Chinese planes or drive Chinese APCs anytime soon, Argentine soldiers will drive Chinese vehicles. Buenos Aires announced in March the arrival of 30 “mobile hospital” trucks for the Argentine Army from China, via a bilateral agreement signed in 2022.

Ultimately, however, Latin American politics can be a tale of ideological extremes. While Milei will likely pursue a pro-Washington foreign policy, his eventual successor could seek to reverse the tide and strengthen relations with China, including in the defense field.

The recent administrations of former presidents Christina Fernández de Kirchner (2007-2015) and Mauricio Macri (2015-2019) demonstrate that this scenario is entirely plausible.

González Levaggi said he believes Beijing “has a long-term vision and will wait for a new government.”

Berg appeared to agree.

“I think over the long run, China has many reasons to feel positive about the amount of leverage that it has built over Argentina,” he said.